The Power Of Compound Interest

When people talk about building wealth, the phrase “compound interest” almost always comes up. Albert Einstein famously called compound interest the “eighth wonder of the world, but how does it actually work?

What Is Compound Interest?

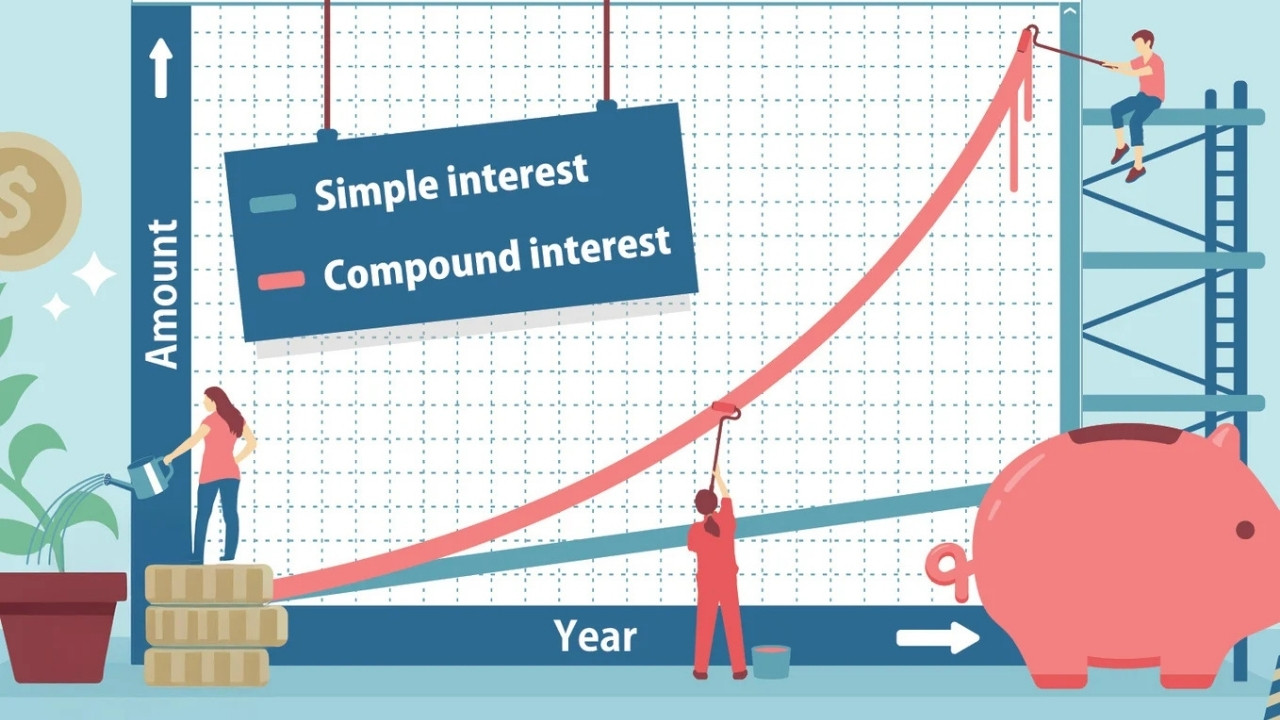

At its simplest, compound interest means you earn interest not only on your original money but also on the interest that money has already earned. Over time, this creates a snowball effect that can turn small savings into something substantial. In other words, your money makes money, and that money also makes money. The result is, you guessed it, more money!

Example 1: Imagine you invest $1,000 at a 5% annual interest rate. If the interest is simple (NOT compounded), you earn $50 every year. After 10 years, you have $1,500. But, with compound interest, you earn interest on the $1,000 in year one, then interest on $1,050 in year two, and so on. After 10 years, your $1,000 grows to $1,628.89, not because the rate is higher, but because of the compounding effect.

Example 2: If you save $100 a month in an account earning 4 percent interest from age 20 to 65, you’d contribute $54,100 over the years. Yet by retirement, your balance would be about $151,550. That means nearly two-thirds of your total comes from interest, not your own deposits.

This is why starting early, even with small amounts, can pay off hugely over decades. Time is the magic ingredient that makes compound interest so powerful.

Quick Trick: The Rule of 72

If you want to estimate how long it takes to double your money, divide 72 by your interest rate.

- At an 8 percent return, your money doubles about every 9 years (72/8 = 9).

- At 6 percent, it doubles every 12 years. (72/6 = 12)

The Rule of 72 is a handy shortcut for understanding how fast your savings might grow.

When Compound Interest Works Against You

Unfortunately, compound interest isn’t always your friend. It can work in reverse when you’re dealing with high-interest debt, like credit cards or certain loans.

Credit Card Example:

- The average credit card interest rate today hovers around 24.2 percent.

- Carrying a $5,000 balance and paying only the minimum could take 17 years to pay off, and cost nearly $9,000 in interest alone.

Minimum payments barely chip away at your balance because interest keeps piling on top of itself.

Other Sneaky Ways Compound Interest Hurts

- Personal Loans: Some loans calculate daily interest. Even small balances can grow surprisingly fast if you only make minimum payments.

- Variable Rates: Credit cards and some lines of credit can raise your interest rates, which means your debt compounds even faster.

- Subscription Traps: Small recurring charges can quietly build up, especially if you carry them on high-interest cards.

The Good vs. The Bad

When It Helps You

- Interest earns more interest on savings and investments

- Helps you grow wealth over time

- Works even with small amounts invested regularly

When It Hurts You

- Interest compounds on unpaid debt balances

- Keeps you stuck in debt longer if you pay only minimums

- Can spiral out of control if rates are high

Smart Strategies to Make Compound Interest Work For You

Start Early: Even small amounts can grow dramatically when you give them time.

Automate Your Savings: Set up automatic monthly transfers into savings or investment accounts so you never forget.

Take advantage of employer matching: If your employer offers a 401(k) match, contribute enough to get the full match. It’s essentially free money that compounds.

Pay Down High-Interest Debt First: Focus on debts charging more than about 6 percent interest before you prioritize investing. The money you save on interest is guaranteed “earnings.”

Don’t Settle for Minimum Payments: Always pay more than the minimum on debts to avoid letting compound interest balloon your balance.

Bottom Line

Compound interest is one of the most powerful financial tools. It can help you build wealth faster than you might imagine or trap you in long-term debt if you’re not careful.

The key is simple: use compound interest to your advantage in savings and investments and protect yourself from its harmful side when it comes to debt.

Even if you’re starting small, taking action today can make a huge difference in your future financial freedom.

Next Steps

- Try a compound interest calculator online to see how your money could grow.

- Review your debts and target the highest-interest balances first.

- Consider opening or contributing more to a retirement account to take full advantage of compounding.

Remember: Whether compound interest works for you or against you is entirely up to how you manage your money. Learning to harness its unique power can make all the difference to your financial health!