Learn how to open your Emergency Savings account from the Members 1st mobile app or online banking in just a few minutes. Get started now and start saving.

Read More >Earn 3% APY on our Emergency

Savings when you bundle and save

How to Open an Account

Opening an account is easy and we’re here to help if you need it.Open Your Account

Current members can open an Emergency Savings in the mobile app, by phone, or by visiting a branch. New customers can visit www.m1cu.org/NewAccount/.

Start Contributing

Make regular contributions to your account. Considering setting up an automatic transfer. Add what you’re able, even small amounts add up quickly.

Maintain Your Savings

Replenish your Emergency Savings after an unexpected expense. As your balance grows, consider upgrading to higher-yielding Money Market or Certificate account.

How We Compare

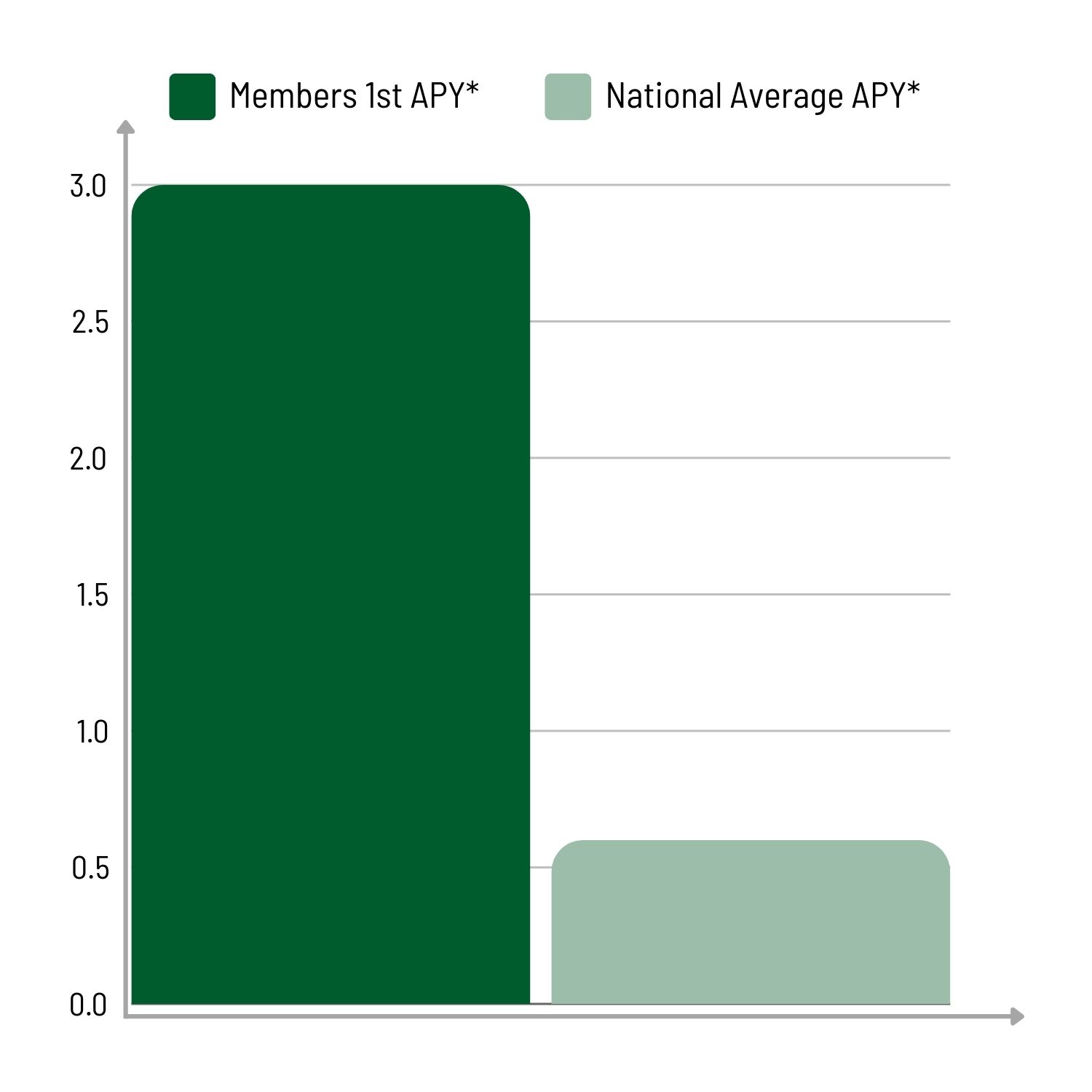

Our members earn more than the national average2

2. Based on the national APY* average on savings accounts in the US according to Bankrate as of 09/17/2024.

Rates

APY*

Rates

Emergency Savings

3.00%

Fixed up to $1,000

(0.03% for amounts greater than $1,000)

$0 minimum deposit

3.00%

Fixed up to $1,000

(0.03% for amounts greater than $1,000)

Account Features

All your favorite account features and benefits.Earn up to 3.00% APY

Earn 3.00% APY on the first $1,000 in your account.

No Minimum Balance

Keep as much or as little as you like in your savings, without having to worry about a fee.

No Monthly Fee

No monthly fees. No annual fees. No worries.

Track Your Savings

Track your savings with our free mobile app or online banking.

Mobile Deposit

Deposit checks directly into your account with your mobile or tablet device.

Notifications

Receive email and text notifications for all types of activity on your account.

Accessible

Keep your money accessible while you earn dividends.

Tiered Dividends

Tiered dividends allow your savings to grow faster.

Opens Quickly

Open your account from the Members 1st app in seconds.

Save Faster When You Add Stash

Turn your small change into a big deal when you enroll in Stash. Round up your debit card purchases to the next dollar to be added into your Members 1st savings, auxiliary savings, holiday savings, emergency savings, mem-bear savings, or money market account.

Learn MoreCompare Accounts

1. Stated Annual Percentage Yield (APY) is determined by your minimum account balance.

Resources

Emergency Savings Tutorial

Is the Money in My Account Safe?

Your financial institution is one of the safest places to store your hard-earned cash. The best part? All you have to do is open an account. Your M...

Read More >

More Ways To Save

At Members 1st, we understand the importance of being prepared for unexpected expenses. That's why we offer resources and support to help you buil...

Read More >APY = Annual Percentage Yield. 3.00% APY is applied to the first $1,000 in your account. Amounts exceeding $1,000 will earn 0.03% APY.

We may use tracking pixels, cookies, and other similar tools, which are provided by third parties, to improve our website, enhance your browsing experience, serve personalized ads or content, market our services, and analyze our traffic. By clicking "Accept & Close," you consent to our Consumer Privacy Policy and Digital Privacy Policy and our use of these technologies. By clicking "Accept & Close," you also recognize and accept that your data and other information you share with us on our website may be transmitted to third parties for the purposes we have identified in our Consumer Privacy Policy and Digital Privacy Policy.